The Thrift Savings Plan hit a big milestone at the end of 2020, even as some participants, experiencing financial hardships during the pandemic, withdrew nearly $3 billion.

The plan ended 2020 with roughly $710 billion in assets and a record 6.2 million participants.

For some context, the TSP ended 2019 with $632 billion in assets and 5.9 million participants.

So how did it get there?

“We started with a relatively large base of participants and with a relatively large base of participants that has been saving diligently,” Ravi Deo, the Federal Retirement Thrift Investment Board’s executive director, said last week at the board’s public meeting.

The TSP has also seen a steady stream of new participants, mostly uniformed service members who have entered the blended retirement system.

Oh, and the stock market helped too.

“The S fund, the C fund, the I fund all had an extraordinary year, especially given the backdrop of COVID-19 and given the backdrop of a stressed economy,” Deo said. “That has also contributed to asset growth.”

The stock market truly took a rollercoaster ride this year.

At one point the C fund, for example, fell nearly 34% from its Feb. 19 high. Between March 23 and the end of 2020, it rose by 70%, said Sean McCaffrey, the TPS’s chief investment officer.

The S fund fell by more than 41% and then jumped by 114% between March and the end of the year.

At the same time, participants withdrew roughly $3 billion from the TSP thanks to the ongoing COVID-19 pandemic.

The Coronavirus Aid, Relief and Economic Security (CARES) Act, which Congress passed last March, allowed participants to take a one-time withdrawal from 401(k) style plans like the TSP.

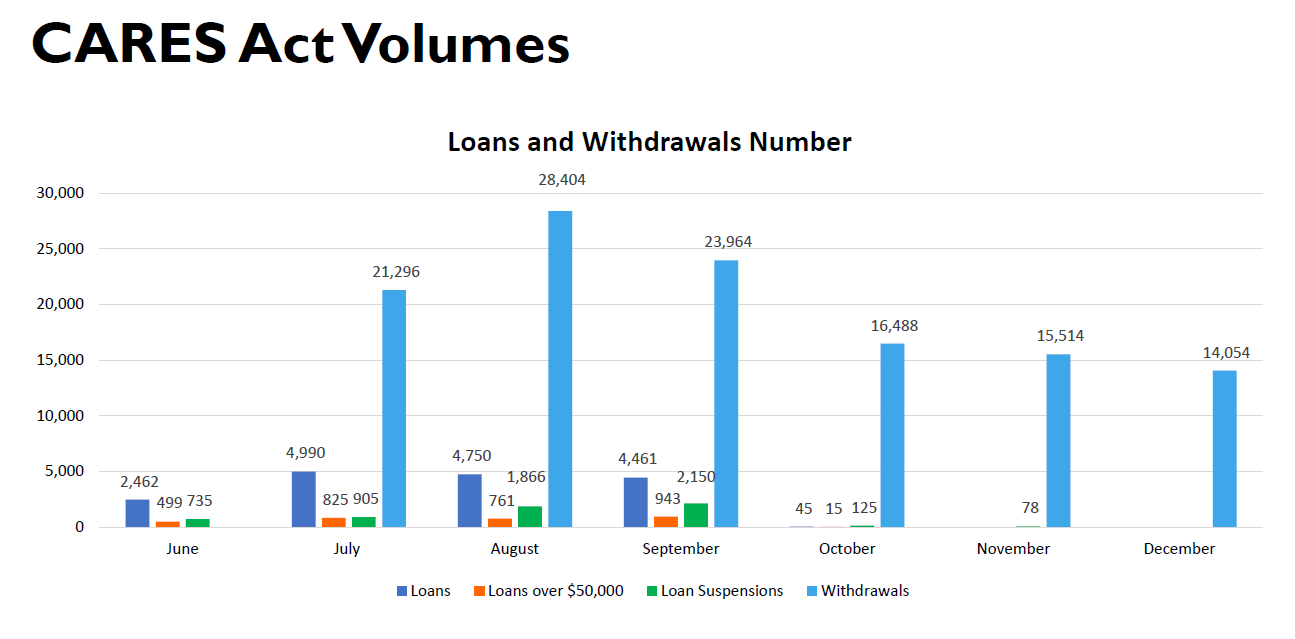

Participants made a total of 119,720 withdrawals from the TSP between July and the end of 2020. Those withdrawals totaled some $2.9 billion.

Some 6,213 participants suspended loan payments last year under the CARES Act flexibilities.

And 3,043 participants took loans higher than the usual $50,000 limit, worth a total of $229 million.

To qualify for the CARES Act flexibilities, participants had to be diagnosed with COVID-19, have a spouse or dependent with the virus or experience adverse impacts because of the pandemic. Those impacts included losing work hours, being laid off, furloughed or quarantined, or being unable to work because of a lack of school or child care options.

These CARES Act flexibilities expired last year.

New year, new administration, same board

And remember all that drama with the TSP and the I fund last year?

Pressure from the White House prompted the FRTIB to reverse course and pause plans to move the international fund to a China-inclusive index.

The situation inspired some rare attention from national media outlets. It eventually prompted President Donald Trump to tap new appointees to replace three of the five board members.

But the Senate never confirmed them, meaning the four remaining TSP board members will stay, at least for now, to serve under a third president.

“The FRTIB is a non-partisan board,” David Jones, the acting chairman, said. “Each of us has a responsibility to serve as fiduciary for all of the participants and beneficiaries of the Thrift Savings Plan. We’ll continue to do so, as we have for many years now, until we are replaced.”

Nearly Useless Factoid

By Alazar Moges

Unexpectedly, the coldest ever recorded temperature in the U.S. was set in Alaska. The mercury plummeted to 80 degrees below zero on Jan. 23, 1971 in Prospect Creek in central Alaska. The coldest temperature recorded in the contiguous U.S. is 70 degrees below zero, measured at Rogers Pass, Montana, on Jan. 20, 1954. The only state that has not seen a subzero temperature is Hawaii. The coldest temperature recorded in Hawai’i is 12 degrees at the Mauna Kea Observatory, which is at an elevation of 13,796 feet, on May 17, 1979.

Source: The Weather Channel