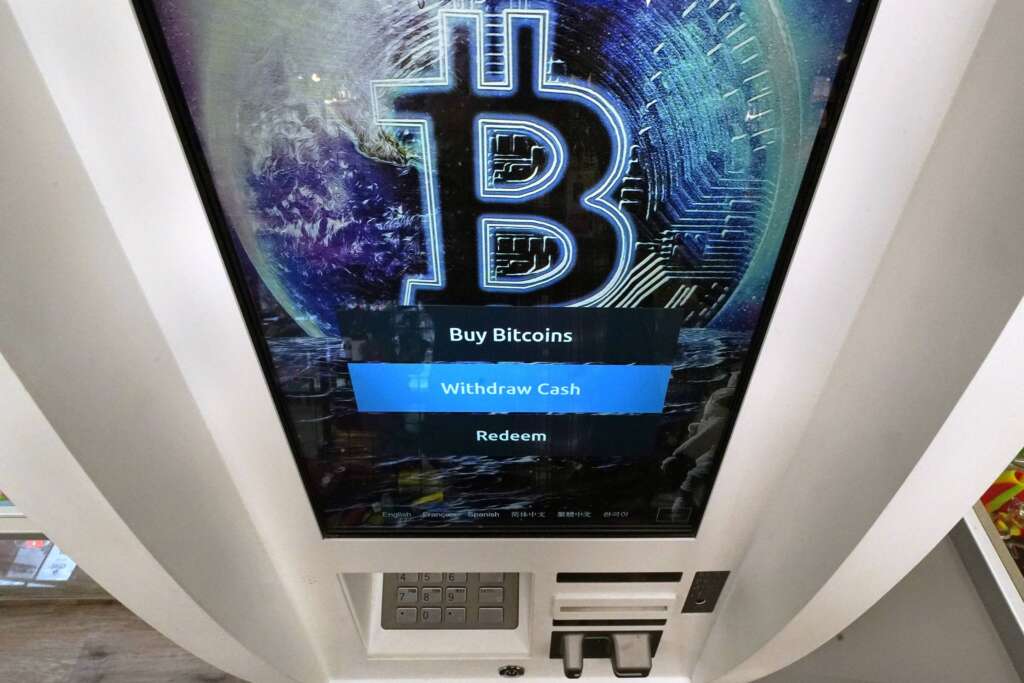

NEW YORK (AP) — Interested in Bitcoin but don’t want to open a crypto trading account? Wall Street has something for you.

ProShares said Monday it plans to launch the country’s first exchange-traded fund linked to Bitcoin. The ETF with the ticker symbol “BITO” is expected to begin trading Tuesday, barring any opposition from regulators.

It’s the latest milestone for Bitcoin and for the ETF industry in general. In a statement, ProShares CEO Michael Sapir compared the launch of a crypto-linked ETF to the 1993 launch of the first stocks ETF and the 2002 rollout of the initial bond ETF. The U.S. market for ETFs has grown to more than $5.4 trillion and they’re owned by roughly 9% of all the nation’s households, according to the Investment Company Institute.

Cryptocurrencies, meanwhile, have exploded into a nearly $2.5 trillion industry after the creation of thousands of digital currencies. Bitcoin is the biggest of them all, with a total value of nearly $1.2 trillion. But like much in the crypto world, the Bitcoin-linked ETF is a bit complicated.

The fund won’t invest directly in Bitcoin itself. Instead, it will focus on futures related to Bitcoin, a market that’s overseen by U.S. regulators and can be complicated in its own right. That means investors need to be particularly aware of what they’re buying, and how it’s likely to perform.

Here’s a look at what the ETF does and doesn’t do:

WHY IS THIS A BIG DEAL?

A Bitcoin-related ETF would give investors a new way to get involved in the fast-growing field of cryptocurrency. Bitcoin’s price has more than doubled this year, and a growing number of investors see it as a way to offer their portfolios some protection.

The hope is that Bitcoin’s price will move in a way that’s not as tied to expectations for the economy as stocks and other investments are. If it does, it could help support portfolios when everything else is falling or when inflation is high. It doesn’t have a perfect track record, though: When the U.S. stock market fell nearly 34% at the start of the pandemic in 2020, Bitcoin lost roughly as much.

Some investors may not want to open a new trading account for cryptocurrencies. Instead, they can buy the ETF through old-school brokerage accounts they may already be using for their stocks or their IRA.

WHAT IS AN ETF?

An exchange-traded fund allows investors to easily buy a whole basket of investments. Some of the most popular ETFs track things like the S&P 500 index of big U.S. stocks, the price of gold or high-yield bond indexes.

Unlike with a traditional mutual fund, which prices just once a day, investors can buy or sell an ETF throughout the trading day. That’s particularly important for cryptocurrencies, whose prices can swing sharply from minute to minute, let alone day to day.

SO THIS NEW ETF WILL TRACK THE PRICE OF BITCOIN?

No, and this is one of the most important distinctions. The fund will invest in Bitcoin futures, which are essentially bets on where Bitcoin’s price will go in each of the months ahead.

The Bitcoin futures market is overseen by the Commodity Futures Trading Commission, which may offer investors more protection. But it also doesn’t perfectly track the price of Bitcoin.

“This is not a replacement for owning bitcoin directly,” said Todd Rosenbluth, head of ETF and mutual fund Research at CFRA.

WHO IS THIS BEST SUITED FOR?

Because it will be invested in futures instead of actual Bitcoins, the ETF is less than ideal for a Bitcoin believer who wants to invest in it for the long term, Rosenbluth said.

Instead of a buy-and-hold investor, he said it’s more likely to be popular with shorter-term traders who want to make money off its volatility, at least initially. There’s certainly plenty of opportunity for that.

In the span of roughly three months earlier this year, Bitcoin more than halved from nearly $64,900 to less than $30,000. Since that low point in July, it’s surged back to nearly $61,800.

HOW MUCH WILL IT COST?

BITO will have an expense ratio of 0.95%. That means $95 of every $10,000 invested in the fund will go toward paying its annual operating expenses.

Such fees could be a hard sell for Bitcoin fans, many of whom see cryptocurrencies as a way to erase middlemen from industries.

IS THIS THE FIRST AND LAST SUCH ETF?

No, several other fund companies have their own applications for ETFs linked to Bitcoin futures. Some may try to separate themselves by charging lower fees.

Beyond just extending the reach of Bitcoin, the ETFs will help create a bigger ecosystem in the financial world around it, said Ben Johnson, director of global ETF research at Morningstar.

With a Bitcoin-linked ETF, skeptical investors will have something that they can sell short. In such a trade, they can bet on the ETF’s price to fall by borrowing a share and selling it, hoping to buy it back later at a lower price. The ETFs could also allow for trading of options around them.

“The money made on all that trading activity is going to dwarf the money made just on collecting fees for those products,” Johnson said.

Copyright

© 2021 . All rights reserved. This website is not intended for users located within the European Economic Area.