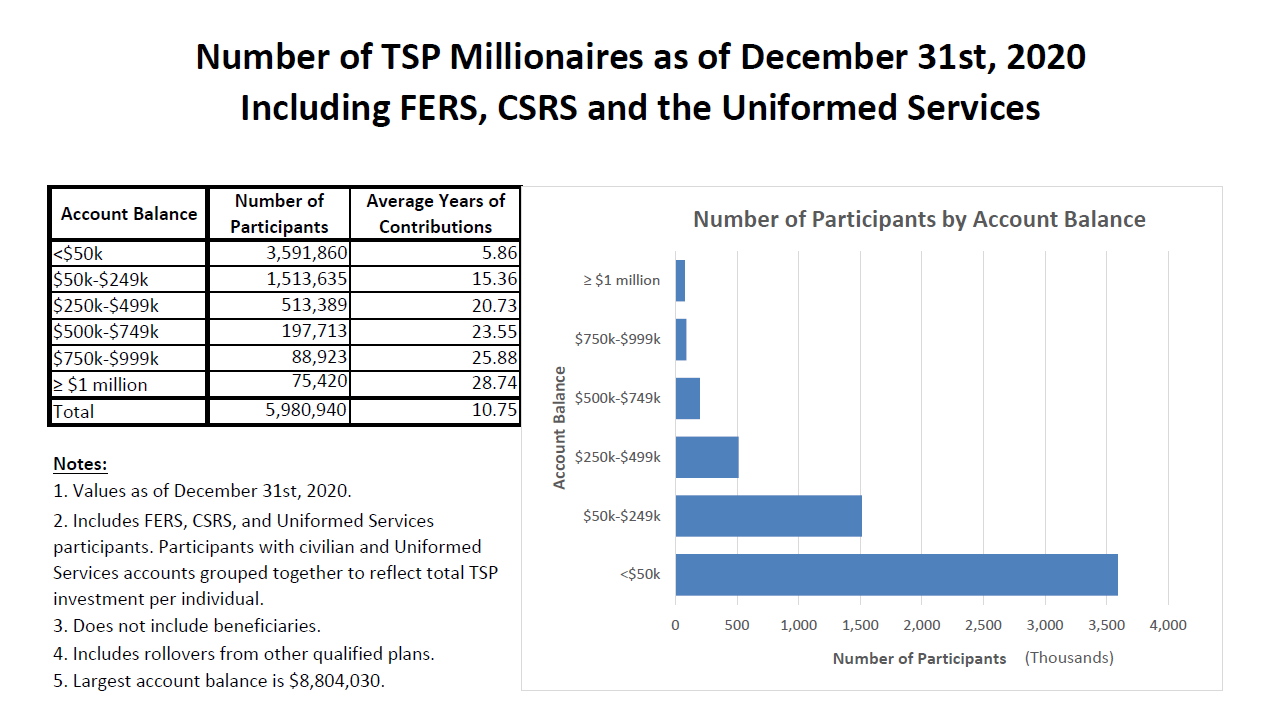

The number of federal workers and retirees with $1 million or more Thrift Savings Plan accounts jumped to 75,420 as of Dec. 31, 2020. That is up from 49,620 in December of 2019.

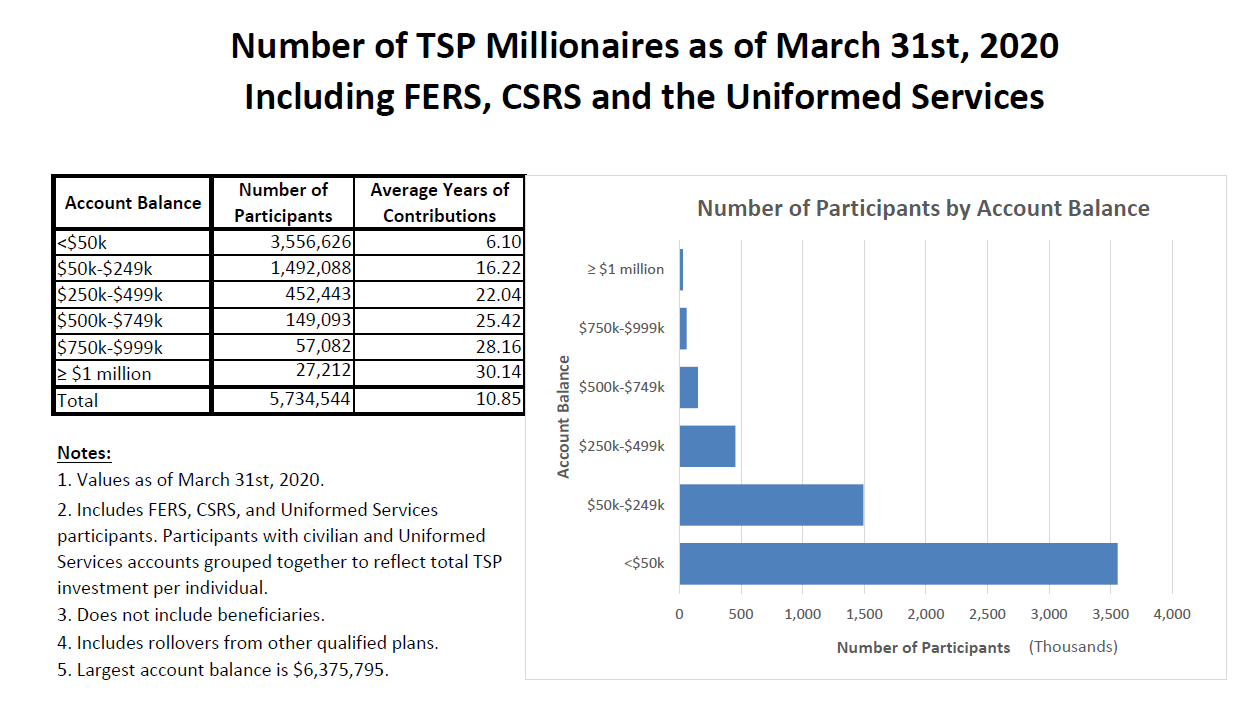

After the record 11 year bull market corrected more than 30% in March of last year, the number of civil servants with TSP accounts worth $1 million or more dropped to 27,212. But instead of losing faith in the stock market, and prepping for a long recession, many TSP investors held on to their shares in the stock-indexed C and S funds. Many also bought more during the brief period early last year when the market was down and shares were, in effect, on sale.

Between March 31 and Dec. 31 of last year, the largest TSP account balance jumped from $6.37 million to $8.8 million. All account information is confidential, but some people who watch the TSP believe the top account may belong to a successful lawyer appointed to the federal bench years ago. The TSP, with 5.9 million active and retired participants, is Uncle Sam’s in-house 401k plan for civilian and military personnel.

When the Federal Employees Retirement System (FERS) replaced the Civil Service Retirement System (CSRS), workers were put under Social Security. The civil service formula for pensions was reduced. But it also created the TSP to help workers finance their own retirement. And the government provided a match of up to 5% for account holders covered by FERS. At the time it was estimated that the TSP would provide anywhere from one-third to as much as one-half of all the cash FERS employees would have in retirement. The vast majority belong to the TSP and contribute enough to get the full government match.

While many focus on the number of self-made millionaires in the program, the number closing in on seven-figures is rapidly increasing. At of the end of last March, there were 57,082 with account balances between $750,000 and $999,000. At the end of of December 2020, that number had jumped to 88,923. If the stock market continues its upward climb, some TSP account holders hope to have $2 million or more in their retirement accounts by mid-summer.