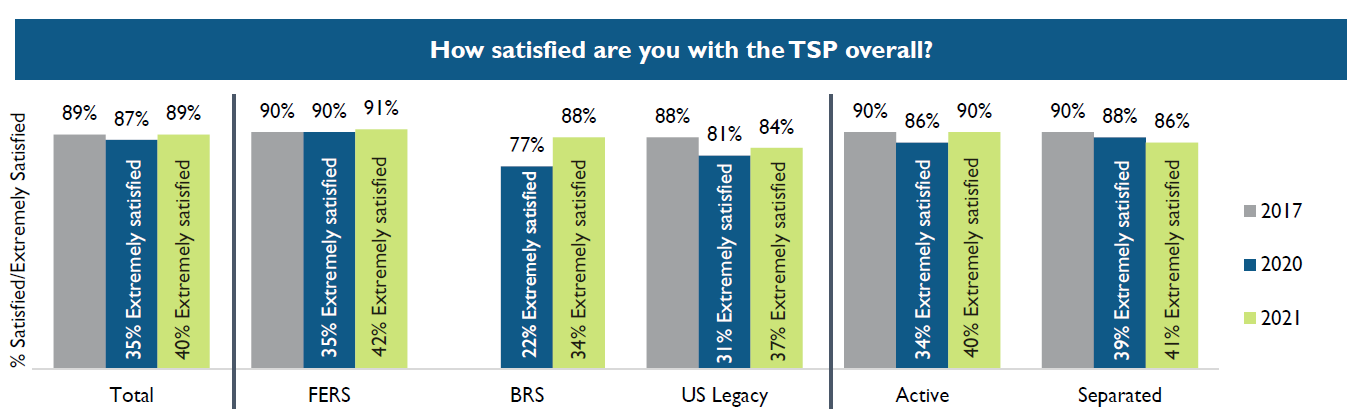

Most participants are still largely pleased with the Thrift Savings Plan, with satisfaction rebounding slightly in 2021 compared to the previous year.

According to a recent survey of 5,000 participants, 89% were satisfied with the TSP in 2021, compared with 87% last year.

Part of the satisfaction bump comes from military members in the still-relatively-new blended retirement system (BRS). Some 88% of BRS participants said they’re satisfied with the TSP, compared to a 77% satisfaction rate among military members in 2020. In that group, 33% of BRS participants said they were “extremely satisfied” with the plan, compared with 22% last year.

The Federal Retirement Thrift Investment Board, the agency that oversees and administers the plan, again partnered with Gallup to survey a sample of some 36,000 participants. The survey results often inform new plan offerings and tools, the agency said.

In the past, the agency conducted surveys every two-to-three years but will solicit feedback from participants through an annual survey moving forward.

TSP satisfaction continues to outpace that of other private sector retirement plan holders. According to a January 2021 retirement confidence survey from the Employee Benefit Research Institute (EBRI), some 84% of American workers are satisfied with their retirement plans.

As the TSP has seen in prior surveys, participants who contribute more are more satisfied with the plan.

Of the 50% of respondents who said they contribute more than 5% toward their TSP, 94% are satisfied with the plan.

Compare that with the 29% of respondents who said they contribute at the 5% level and the 10% who contribute less than 5% toward the TSP. Among those groups, satisfaction with the plan sat at 90% and 86%, respectively.

Among those who contribute less than 5% of their basic pay toward their TSP, 43% said they can’t afford to contribute more.

Another 31% said they simply never changed their contribution amounts, an increase over last year’s rates, when 26% cited inertia as their top reason for not contributing at least 5% toward the TSP.

Fewer people are citing affordability as their top reason for contributing, the TSP noted. In 2017, 53% of active participants contributing less than 5% said they couldn’t afford to save more, while 47% cited affordability at their top reason in 2020.

Participants want more flexibility with withdrawal options

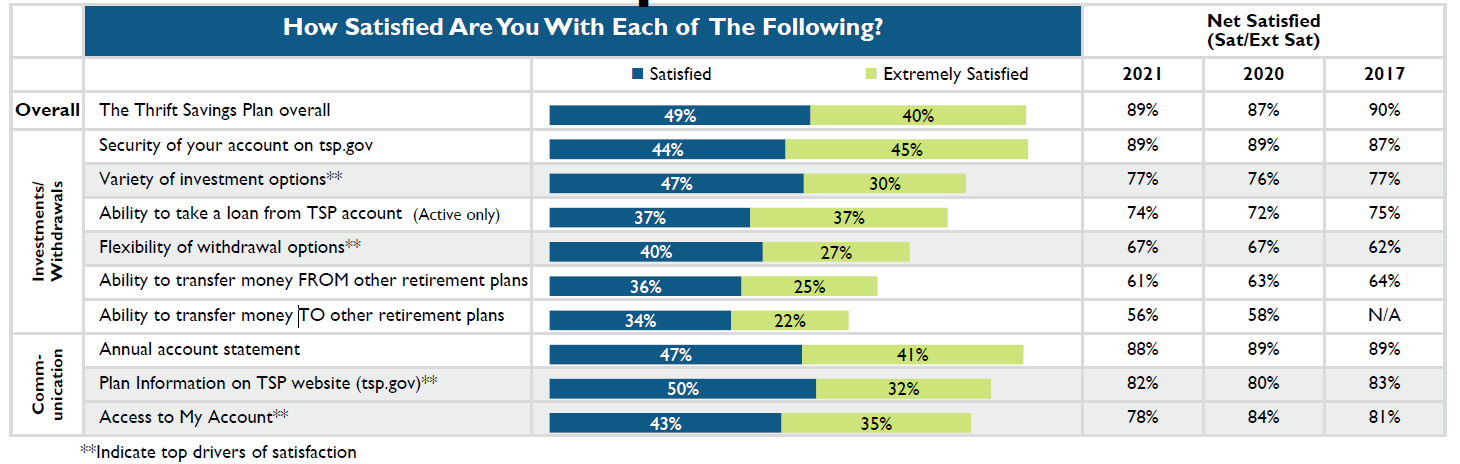

Previous TSP surveys found participants looking for more flexible options to withdraw funds from their accounts. The FRTIB added a series of new options back in 2019, and while a majority of participants like them, many are looking for even more flexibility.

About 67% of participants said they’re satisfied with the flexibility of the TSP withdrawal options. That’s an improvement over 2017, when 62% said they were pleased with them. The FRTIB expanded those options two years later, but the ability to transfer money in and out of the plan remains the lowest-rated aspects of the TSP, according to the survey.

When it comes to those specific withdrawal options, active and separated participants said they’re most likely to use recurring specified payments, partial payments and life expectancy installments, according to the TSP survey.

The FRTIB recently conducted a separate survey of participants to gauge what factors they consider when making a withdrawal or buying an annuity, and the agency said it’ll make its results and analysis available in the coming months.

About four in 10 participants said they plan to transfer money out of the TSP after they retire, citing more and better investment options, the potential for higher returns on those investments and the desire to consolidate retirement accounts as top reasons.

More blended retirement system participants, 58% of them, said they planned to transfer money or rollover their TSP balance, compared to other participants.

When it comes to adding new features, 90% of participants said they wanted the ability to specify the investment funds they use to take a withdrawal, a suggestion Federal News Network has heard from readers as well. The FRTIB said it will consider the option once it finishes a large-scale modernization effort that’s supposed improve customer service, upgrade its internal IT infrastructure and provide a suite of new services and tools to its participants.

Among those new tools is a TSP mobile app, which nearly two-thirds of participants said they wanted, according to the latest survey.

How do TSP fees stack up against other plans?

Participants’ perceptions of TSP fees were a surprise to the board. According to the survey, 46% of participants said, for example, they planned to transfer money out of the TSP in search of lower fees.

The vast majority of participants, some 60% of respondents, said they knew about the TSP’s fees or had an opinion of them.

Of the remaining 40% of respondents who did have an opinion, nearly three-quarters of participants said the TSP fees were among the lowest compared to other 401(k) plans, while 22% believed they were in line with other defined contribution plans.

Just 4% of participants believed the TSP had some of the highest fees compared to other similar plans.

According to the FRTIB, total TSP expense ratios range from 0.49-to-0.6%. For reference, less than one-third of all other comparable defined contribution plans have an expense ratio less than 2.5%, said Steve Huber, enterprise portfolio management chief at the FRTIB.

“We were a bit surprised that most of our survey respondents either didn’t know or think TSP fees are on par or higher than the defined contribution industry average,” he said Tuesday at the board’s monthly meeting.

The agency said it sees an opportunity to better educate participants that TSP fees are often lower than other plans in the industry.