The January cost-of-living adjustment for federal, military, and Social Security retirees is expected to be between 5% and 6%.

That is much, much bigger than the 1.3% retirees got in January 2021. And it could easily top the last big COLA of 5.8% most retirees got in 2009, as the nation was emerging from a relatively brief but deep recession.

That’s the good news.

The not-so-good news is that the higher COLA could mean the nation is in for an extended period of higher inflation. Many experts predict prices will jump in most sectors as the nation and the world recover from the pandemic. We are already seeing more demand for travel and lodging (at much inflated prices), and shortages that have driven up the cost of new, used and rental cars.

In addition to the headache caused by inflation, it would spell real and permanent financial problems down the road for current federal workers who are under the Federal Employees Retirement System (FERS). And for those already retired under FERS.

That’s because unlike annuities under the old Civil Service Retirement System (CSRS) — and benefits under Social Security — FERS operates with a diet-COLA feature. Once inflation exceeds 2% in the previous year, FERS retirees get a -1% raise in January.

But FERS retirees, because of the diet COLA, will get a smaller increase than Social Security and CSRS retirees. Meaning the January increase for them will be 4% or 5% if the actual increase in inflation (as measured by the Consumer Price Index-W) is 5% or 6%. The exact amount of the COLA depends on inflation between July, August and September over the previous period last year. The COLA will be officially announced in early October.

Many people cheer a bigger COLA. But the downside is that everything costs more, and those whose benefits are linked to inflation — including most private sector pensions and FERS benefits —fall behind big time when inflation rears its ugly head.

The 2022 white collar federal pay raise is working its way through the political-legislative process. The White House has proposed a modest 2.7%. Some House Democrats are pushing for a minimum of 3.2%. Unions, of course, back the higher amount.

The final raise figure may not be known until late October.

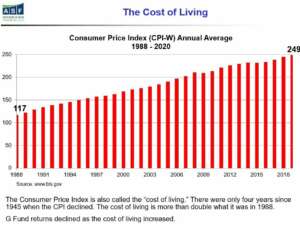

Financial planner Arthur Stein advises his active and retired federal clients not to put all or most of their investments in the super-safe, super-dull Treasury securities G fund. While it is safe, many pros believe that its rate of return isn’t enough to keep pace with inflation and actual living costs in retirement.

Between January and June 30 of this year, the G fund rate return was 0.6%. The F fund (bonds) was down 1.5%, while large stocks (C fund) were up 15.2%. Small stocks (S fund) were up 15.5%, and the higher risk/higher reward international stock (I fund) returned 9%.

Over the last 15 years the G fund returned 2.5%, the F fund was up 4.6%, and the C, S and I funds were up 10.8%, 11.3% and 4.7%, respectively. He produced a chart for his clients showing the steady rise in inflation in recent years.

In times of low inflation, FERS retirees can expect their federal annuity benefits will keep pace with the cost of living. But when inflation takes off, it can mean harder times sooner for the FERS retirees.

Nearly Useless Factoid

By Jonathan Tercasio

Tarzan competed in the Olympics. American actor Johnny Weissmuller, who played Tarzan in 12 movies, won five gold medals in swimming in the 1920s.

Source: The Olympic Games